Pass Freelancer/Fiverr/LinkedIn tests with TOP positions

WordPress, Photoshop, Data Entry, PHP, HTML, Adwords, SEO etc.

We will help you Pass Freelancer Tests, Fiverr Tests, LinkedIn Tests with TOP positions and high score within few minutes.

If are you having problem passing tests, Our experts are here to assist you. All you need to do is to buy our services to contact us and we will be in touch with you and you will have all your required tests passed in no time.

So Save your time and money and let our experts help you pass tests quickly so you can focus on bidding and talking to clients to jumpstart your freelance earnings.

Why Choose Us?

Looking reasons, so that you can trust on us.

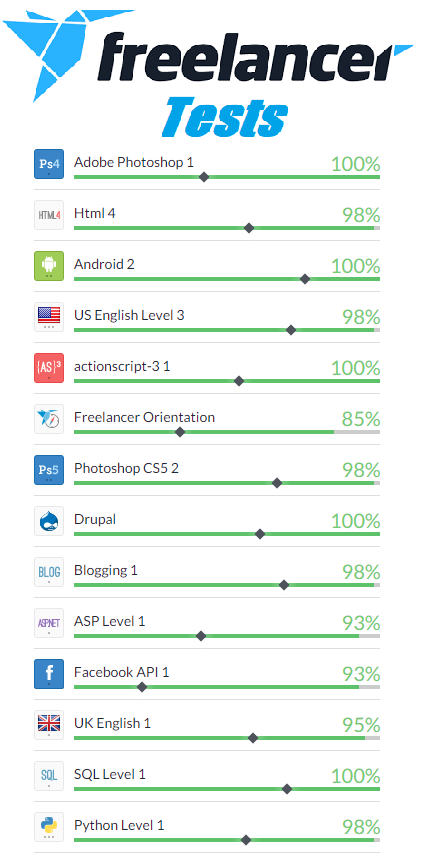

- 100+ Freelancer.com tests Answers

- All Fiverr.com tests Answers

- TOP Positions assurance

- 4 years of flawless services

- 100% PASS Guarantee

Features!

Our tests answers are 100% correct, up-to-date and innovative...

- 24/7 Customer Support

- All skill tests are up to date

- Multiple payment options

- Pass exams within few minutes

- Quick support with Excellent results

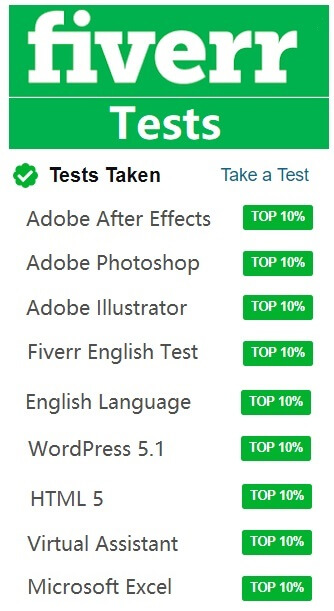

TOP Rated Fiverr Exams

| Exam Name | Success | Last Updated |

|---|---|---|

| Fiverr Adobe Illustrator Test | 100% | 24 Apr, 2024 |

| Fiverr Adobe Photoshop Test | 100% | 24 Apr, 2024 |

| Fiverr Adobe After Effects Test | 100% | 24 Apr, 2024 |

| Fiverr English Language Test | 100% | 24 Apr, 2024 |

| Fiverr English Test | 100% | 24 Apr, 2024 |

| Fiverr U.S English Basic Skills Test Answer - Gig Approval | 100% | 24 Apr, 2024 |

| Fiverr Content Writing test | 100% | 24 Apr, 2024 |

| Fiverr CSS 3 Test | 100% | 24 Apr, 2024 |

| Fiverr HTML 5 Test | 100% | 24 Apr, 2024 |

| Fiverr WordPress 5.1 test | 100% | 24 Apr, 2024 |

| Fiverr Analytical Skills Test | 100% | 24 Apr, 2024 |

| Fiverr Virtual Assistant Test | 100% | 24 Apr, 2024 |

| Fiverr Microsoft Excel Test | 100% | 24 Apr, 2024 |

| Fiverr Customer Service test | 100% | 24 Apr, 2024 |

| Fiverr Social Media Marketing Test | 100% | 24 Apr, 2024 |

| Fiverr SEO Skill Assessment Test Answers - Gig Approval | 100% | 24 Apr, 2024 |

TOP Rated LinkedIn Exams

| Exam Name | Success | Last Updated |

|---|---|---|

| C# Skill Assessment | 100% | 24 Apr, 2024 |

| C++ Skill Assessment | 100% | 24 Apr, 2024 |

| CSS-Cascading Style Sheets Skill Assessment | 100% | 24 Apr, 2024 |

| Final Cut Pro Skill Assessment | 100% | 24 Apr, 2024 |

| Git Skill Assessment | 100% | 24 Apr, 2024 |

| Google Analytics Skill Assessment | 100% | 24 Apr, 2024 |

| Google Cloud Platform (GCP) Skill Assessment | 100% | 24 Apr, 2024 |

| Hadoop Skill Assessment | 100% | 24 Apr, 2024 |

| iMovie Skill Assessment | 100% | 24 Apr, 2024 |

| JSON Skill Assessment | 100% | 24 Apr, 2024 |

| Keynote Skill Assessment | 100% | 24 Apr, 2024 |

| Machine Learning Skill Assessment | 100% | 24 Apr, 2024 |

| MATLAB Skill Assessment | 100% | 24 Apr, 2024 |

| Maven Skill Assessment | 100% | 24 Apr, 2024 |

| Microsoft Azure Skill Assessment | 100% | 24 Apr, 2024 |

| Microsoft Excel Skill Assessment | 100% | 24 Apr, 2024 |

Let's Kick Exams Now!

Search Any skill test that you want to pass in TOP Scores